In Saskia Sassen’s opening keynote, she spoke of “a new systemics” that has come to dominate finance — the rise of complex instruments such as credit default swaps that allow firms to in essence sell what they do not actually own. This is what she calls finance as capability (from Latin capere, to take), rather than money. But what is perhaps most interesting is her characterizing of these financial instruments as “forms of knowledge” that require skills far outside what we normally associate with the world of banking. As she elaborates in her recent book Expulsions:

At the heart of finance is the work of inventing and developing complex instruments. It is the mathematics of physics and its models that are in play here, not the mathematics of microeconomic models. Exemplifying it all, Goldman Sachs’s backroom is well stocked with physicists. The mathematics of the backroom is mostly well beyond the understanding of the highly paid executives of the boardroom. (Sassen, Expulsions, 2014: 119)

Indeed even a quick glimpse at the job postings for Goldman Sachs reveals the firm’s ongoing thirst for individuals with the aptitudes needed to develop — as the website explains — “quantitative and technological techniques to solve complex business problems,” i.e. to utilize their “mathematical and scientific training to create financial products, measure risk, and identify market opportunities.” The advertisement for positions in “strats,” as the field is known in financial circles, possesses its own curious poetry of capital: “cutting-edge derivative pricing models,” “automated trading algorithms,” “analyze exposures, structure transactions,” “risk management alternatives”… Concretely, the mathematical skills required include partial differential equations, stochastic calculus, time series analysis, and statistics and numerical techniques.

Considering finance as a form of knowledge brings to mind the concept of “general intellect” first developed by Marx but more recently redeployed in a range of post-operaist critical theories. Briefly, general intellect insists on the public-ness of thought, which is no longer to be understood as secluded and solitary reflection but rather as “something exterior and collective, […] a public good.” Intellectual activity, once it finds its place within the means of production, becomes necessarily “exterior, collective, social.” (Virno, A Grammar of the Multitude, 2004: 37-38) But the mobilization of pure mathematical knowledge, acquired over centuries of painstaking inquiry, in the realm of financial engineering turns this public good toward ends of private gain. This can even be understood quite literally, with the draining of physicists from publically funded scientific projects into private financial firms. From Switzerland’s CERN particle accelerator — one of the most prestigious research centers in the field — scientists have left to work in credit and mortgage structuring at Goldman Sachs, to strats and modeling at Morgan Stanley, to quantitative research at JP Morgan… the list could be prolonged. If, in the nineteenth century, the general intellect was something fixed in the great machines that powered industry, today it is fixed in the bodies, and minds, of such individuals. And finance is where surplus value is being most effectively extracted from that intellect. (See Marazzi, Capital and Language, 2008: 44)

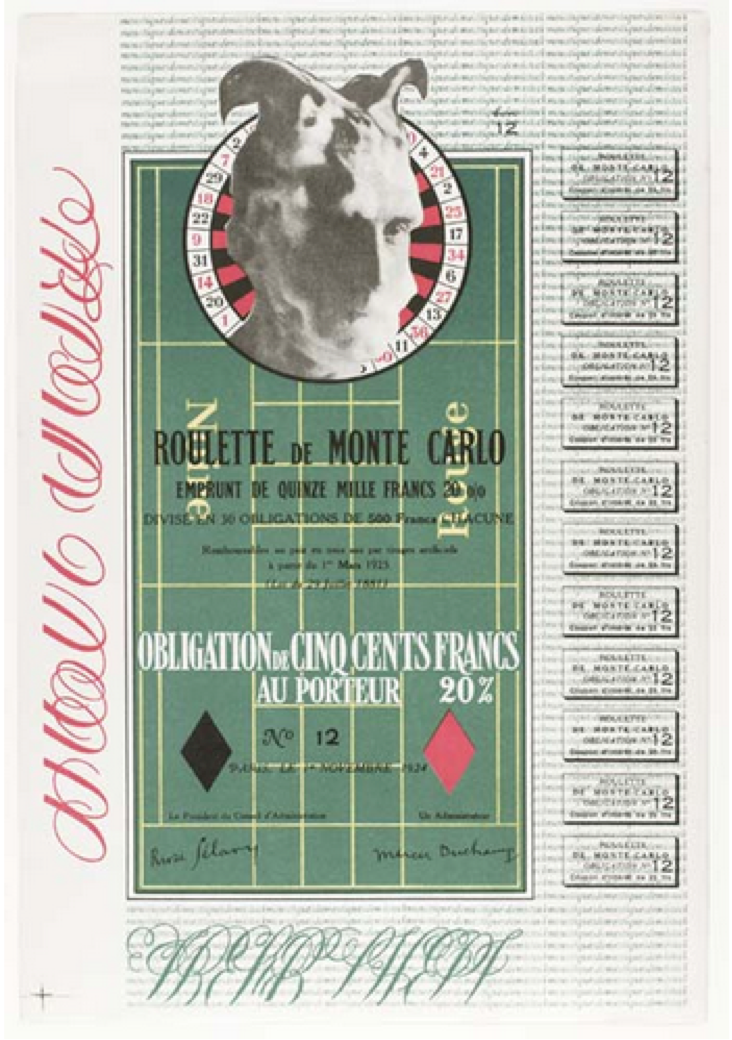

What has this to do with contemporary art? We might begin by insisting that financial engineering isn’t entirely foreign to this realm, and not only in the form of the increasingly sophisticated algorithms used to model the behaviors of the art market. It has also long been present as a site that might be occupied by artists. Wasn’t this the gesture of Marcel Duchamp’s Monte Carlo Bond (1924-1938)? As with Sassen’s definition of finance — the selling of something that doesn’t belong to you — Duchamp hoped to use the sales of these bonds to underwrite his interest in gambling, promising investors a return of 20%, to be funded from his roulette winnings. Despite the ultimate failure of the plan — only a handful of the bonds were ever sold — it was a prescient gesture. Robert Morris would update the strategy four decades later in Money (1969-73), a work produced for the Whitney’s “Anti-Illusion” exhibition, in which he invested $50,000 of a trustee’s funds in the stock market.

How should we consider such occupations of the space of finance and speculation? Perhaps we can find an analogy in art history. In a famous text of the early 1970s, Michael Baxandall analyzed the “period eye” of the early Italian Renaissance, exploring the specific perceptual / mental horizons that framed invention of the techniques of perspective. He considered the Florentine merchants who constituted the primary patrons and audience of the paintings and frescoes utilizing this new means of representing the world, and suggested that the mathematical tools of calculation — of weight, of distance — that they had to make use of in their everyday commercial dealings were being redeployed by artists, so that one might exercise those same skills in the space of aesthetic observation. (Baxandall, Painting and Experience in Fifteenth-Century Italy, 1972) For Baxandall, this was a matter of a homology between ways of seeing in the concrete social world and ways of seeing in the visual arts, but mightn’t we see it from a slightly different angle? Rather than insisting on a simple continuity from commercial to aesthetic realms, perhaps this was a matter of artists taking “forms of knowledge” that had been subjected to the means-end rationality of the marketplace and shifting them into a space of perception free of the profit motive. When we make use of our calculative skills to observe a painting, we restore them to their origins in the common, we return them to the general intellect. In a very different economic structure, perhaps Duchamp and Morris perform an analogous operation, diverting finance’s forms of knowledge into the “autonomous” realm of art, working on the borders of private and collective property.

But before concluding, we should consider a last, parenthetical comment from Sassen’s lecture. After her discussion of financial engineering, she mentioned that there were actually two fields in which truly innovative, creative uses of knowledge were presently occurring: physics, as we have seen, and Continental philosophy. Here too, it is a matter of the general intellect, and of what Alain Badiou calls “the adventure of French philosophy.” He names five characteristic aims of this experimental mode of thought: to refuse to divorce itself from existence; to inscribe itself within everyday life; to insist on the unity of theory and praxis; to see itself as an intervention into the political arena; to question the basis of subjectivity; and, finally, to develop a new style of exposition — “to turn philosophy into an active form of writing that would be the medium for the new subject.” (Badiou, The Adventure of French Philsoophy, 2012: lxii) Perhaps these have their own parallels in contemporary artistic practices — at least those that resist simply submitting wholly to the exchange relation. What else could we ask of art as one component of the general intellect, but to be an active form of creation, a medium for a new subject?